Lessons I Learned From Info About How To Tackle Credit Card Debt

Compare best offers from bbb a+ accredited companies.

How to tackle credit card debt. Find a lender & consolidate your debt today. This debt — a whopping $1.3 trillion of it — is the trickiest to tackle, financial advisors say. Ad unbiased expert reviews & ratings.

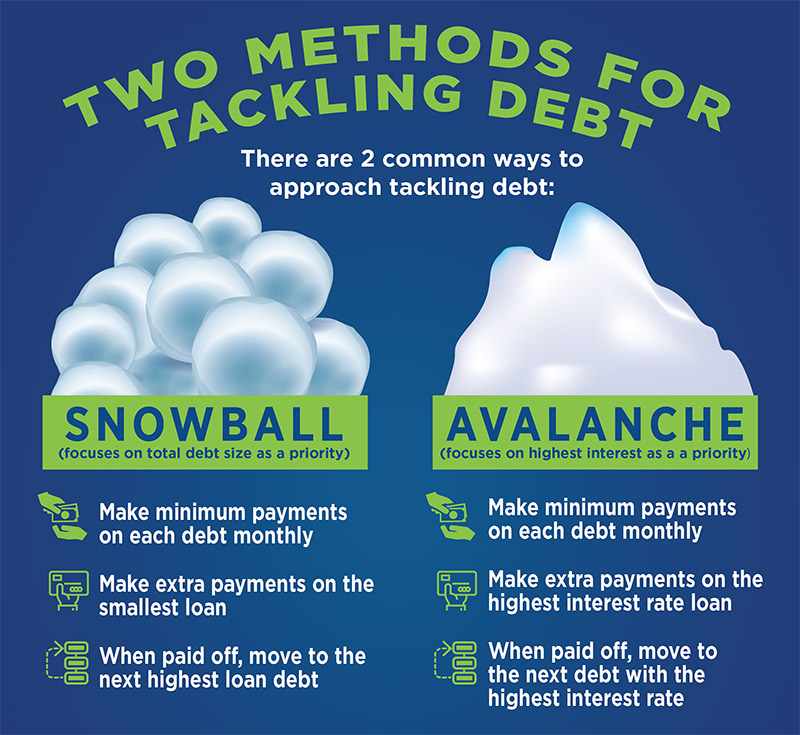

The debt avalanche method is an effective way to get out of credit card debt quickly. A general way to get out of credit card debt is to pay more than the minimum for your card each month. National debt relief is our highest rated debt consolidation company on all the parameters

If you’re struggling with credit card debt, you may be able to take advantage of a balance transfer credit card. Federal student loans typically have interest rates in the 4 percent to 6. From here on out, make full.

Otherwise, it could take years to get rid of a balance. Use a balance transfer credit card. The snowball method and the avalanche method.

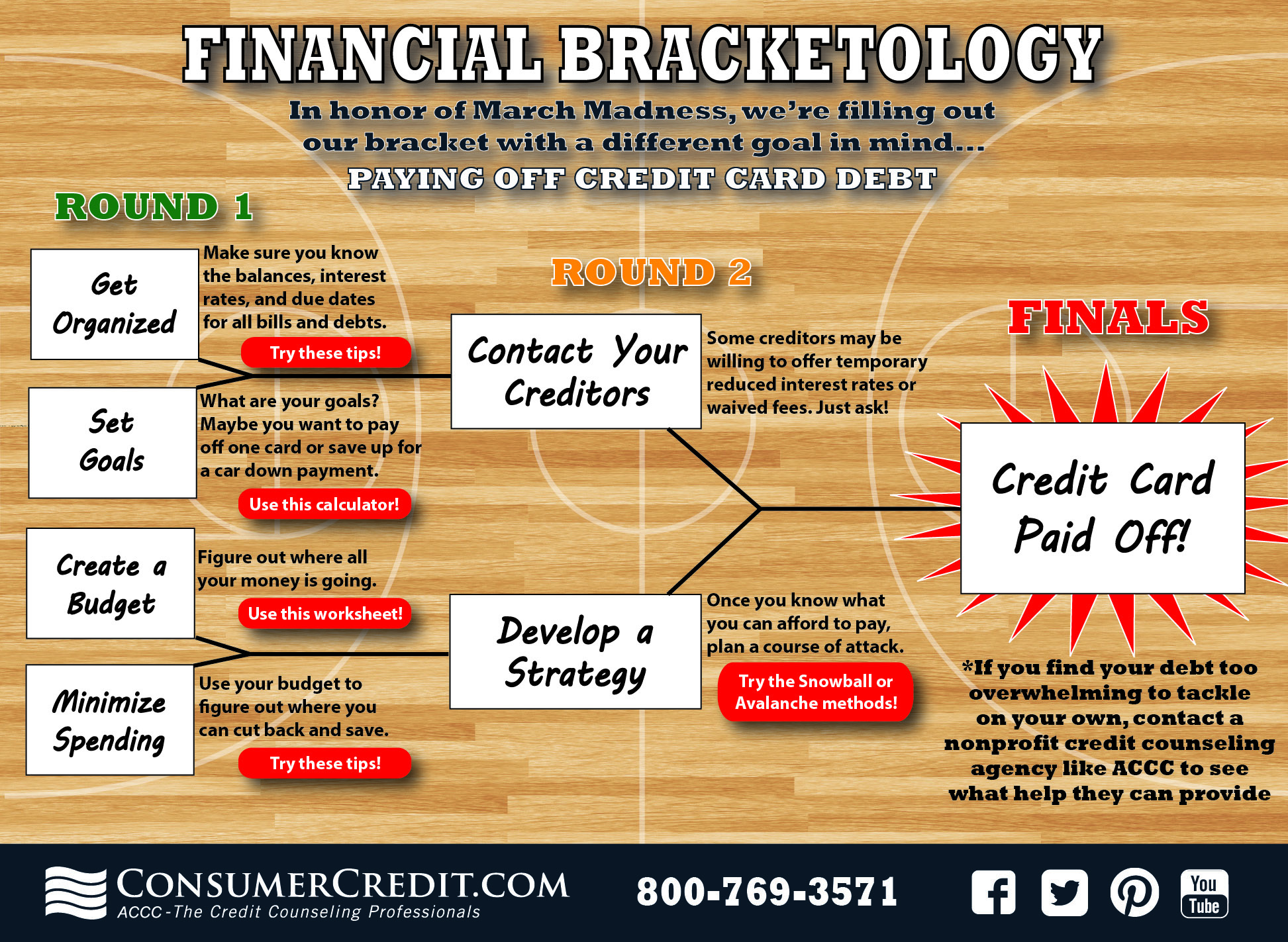

Compare offers for your best rate and lowest monthly payment. Get a free debt consultation. You can employ two common strategies to tackle your debt:

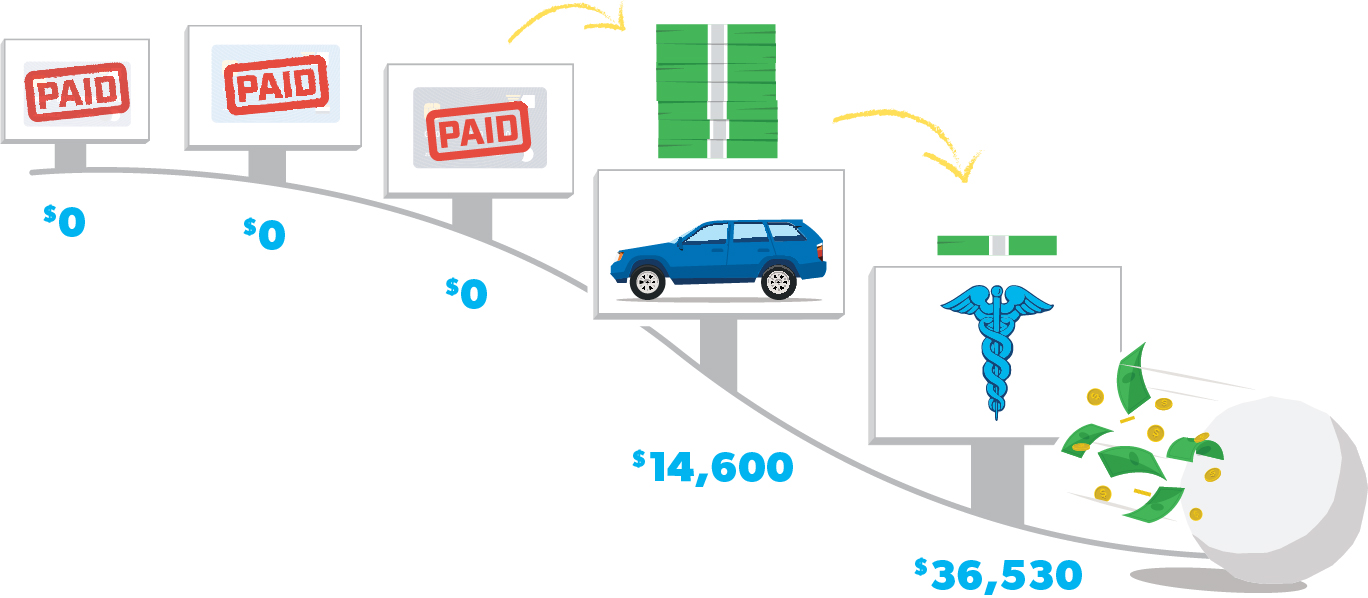

After signing up for a credit monitoring service, here are four other ways to tackle credit card debt. Becca can handle her debt in 3 ways: How should consumers decide what credit card debt to pay off first?